19+ paycheck calculator kentucky

If you are a web payroll. This free easy to use payroll calculator will calculate your take home pay.

Kentucky Paycheck Calculator 2022 2023

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. On the other hand if you make more than 200000 annually you will pay. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State.

Free Kentucky Payroll Tax Calculator and KY Tax Rates. This income tax calculator can help estimate your average income. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Kentucky Salary Paycheck Calculator. Our calculator has recently been updated to include both the latest Federal Tax.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. Supports hourly salary income and multiple pay frequencies. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Simply enter their federal and state W-4 information as. Use our easy payroll tax calculator to quickly run payroll in Kentucky or look up 2022 state tax rates. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Kentucky residents only.

You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. It is not a substitute for the advice. Current Payroll For Payroll USA Customers Estimates made using these payroll calculators will not affect Payroll USAs payroll account information in any way.

Accepted Students Next Steps Georgia State Admissions

Kentucky Hourly Paycheck Calculator Gusto

Kentucky Paycheck Calculator Smartasset

Variation In Hospitalization Rates Following Emergency Department Visits In Children With Medical Complexity The Journal Of Pediatrics

Kentucky Payroll Paycheck Calculator Kentucky Payroll Taxes Payroll Services Ky Salary Calculator

Allsup Reviews What Is It Like To Work At Allsup Glassdoor

Hcup Fast Stats

Kentucky Income Tax Calculator Smartasset

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

8 School Receipt Templates In Google Docs Pdf Word Xls Pages Free Premium Templates

Answered To Help Decide How Much To Charge For Bartleby

G608296 Jpg

Kentucky Income Tax Calculator Smartasset

I M Still Paying Off Child Support Arrears For My Adult Child When Will It Stop Dads Divorce

Wesley Woods Senior Living 2011 Benefits Guide

Kentucky Salary Calculator 2022 Icalculator

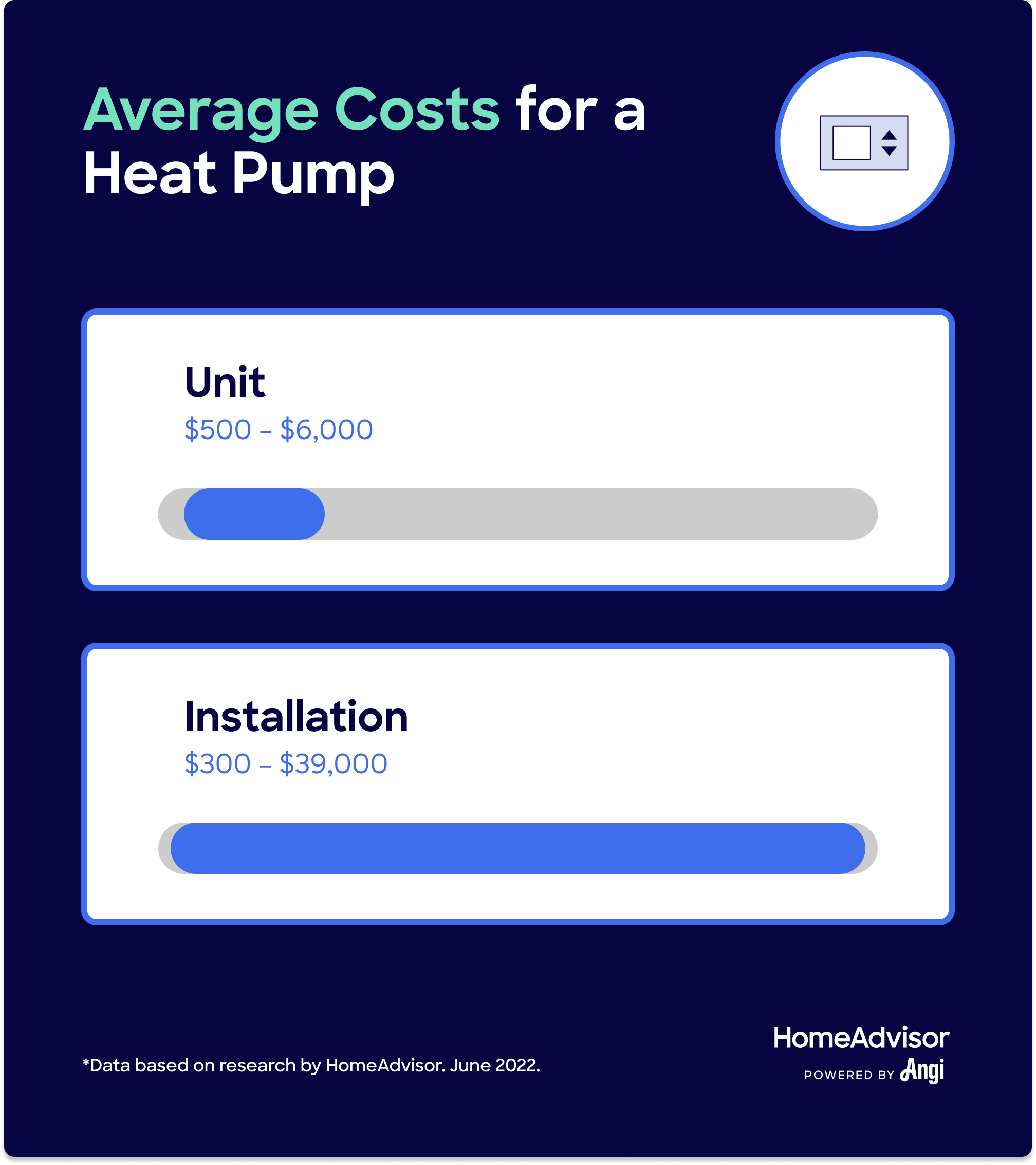

How Much Does A Heat Pump Cost To Install